Understanding Your School Tax Bill

Welcome to wbsdfunding.org, a resource designed by the West Bend School District to provide transparent and factual information about how your property tax dollars fund local education. We understand that tax bills can be frustrating, and we want to ensure you know exactly how the West Bend School District is managing its finances and how we responsibily manage our community's tax dollars.

A Note on Fiscal Responsibility

First and foremost, we want to communicate a central fact: the West Bend School

District is com mitted to fiscal discipline. When isolating the costs that fund public school operations, the District's mill rate has actually decreased this year compared to last.

mitted to fiscal discipline. When isolating the costs that fund public school operations, the District's mill rate has actually decreased this year compared to last.

Your School Tax Bill: Mill Rate vs. Dollar Amount

Can my tax bill increase if the mill rate remained the same from last year?

Yes. This is the most common question we receive and involves a technical but important distinction. The mill rate is the tax rate applied per $1,000 of property value (Tax Levy / Property Value). The District was able to keep the total mill rate the same compared to last year primarily because the total equalized value of property in our community grew significantly (by approximately 9.3%).

However, the total tax levy (the total dollar amount the District is required to collect) did increase. When the total dollar amount collected goes up, and your property value goes up, your individual tax bill dollar amount can also increase, even if the mill rate stays the same.

The Critical Impact of State Funding Policy

The primary factor driving the increase in the school tax levy is a direct result of unusual decisions made in the recent State of Wisconsin biennial budget.

How is the State budget impacting my local property taxes?

School districts receive public funding from two major sources under the Revenue Limit structure: State Equalization Aid and Local Property Taxes (the Levy). When the State contributes more in aid, the local property tax levy automatically decreases, and vice versa.

In an extremely unusual action, the State budget provided a zero increase in State Equalization Aid for this fiscal year and next fiscal year. Simultaneously, the state legislature allowed public schools an increase of $325 per pupil in their Revenue Limit. Because the state provided no aid to cover this mandated increase, the entire $325 per-pupil funding increase was automatically shifted and applied entirely to each local property tax levy.

Simply put, the State chose not to use state dollars to fund the school spending increase, forcing the burden of funding entirely onto local property taxpayers. This is a primary driver of the increase in the District's total tax levy.

Want to learn more? This article from WisPolitics.com provides a detailed analysis of how decisions at the state level impact property taxpayers and school district funding.

How voucher programs affect property taxes and school funding

The second major factor impacting your school tax bill is the State's mechanism for funding the Private School Voucher Program.

Are my property taxes helping to fund the Private School Voucher Program?

Yes. Like public schools, private voucher schools are also funded by a combination of local property taxes and state funding. However, the funding mechanisms are different. In a given school year, payments for voucher students are funded through a deduction in state aid from the students’ resident school district. The state then authorizes the district to levy local property taxes (through a one-time revenue limit adjustment) to replace that loss in state aid. That means that the school levy portion of the property tax bills West Bend School District property taxpayers receive every year includes the costs associated with resident students attending voucher schools that year.

How does the Private School Voucher Program levy affect my taxes?

Unfortunately, your tax bill does not separate between the voucher program funds and other funds related to the school tax levy, which leads to understandable confusion.

-

Of the total $6.14 mill rate for the District, approximately $0.76 is dedicated to funding the voucher program and does not support WBSD operations.

-

If the voucher levy were excluded, the mill rate actually funding the West Bend Public Schools would be only $5.38. This figure represents a reduction in the public school mill rate from last year.

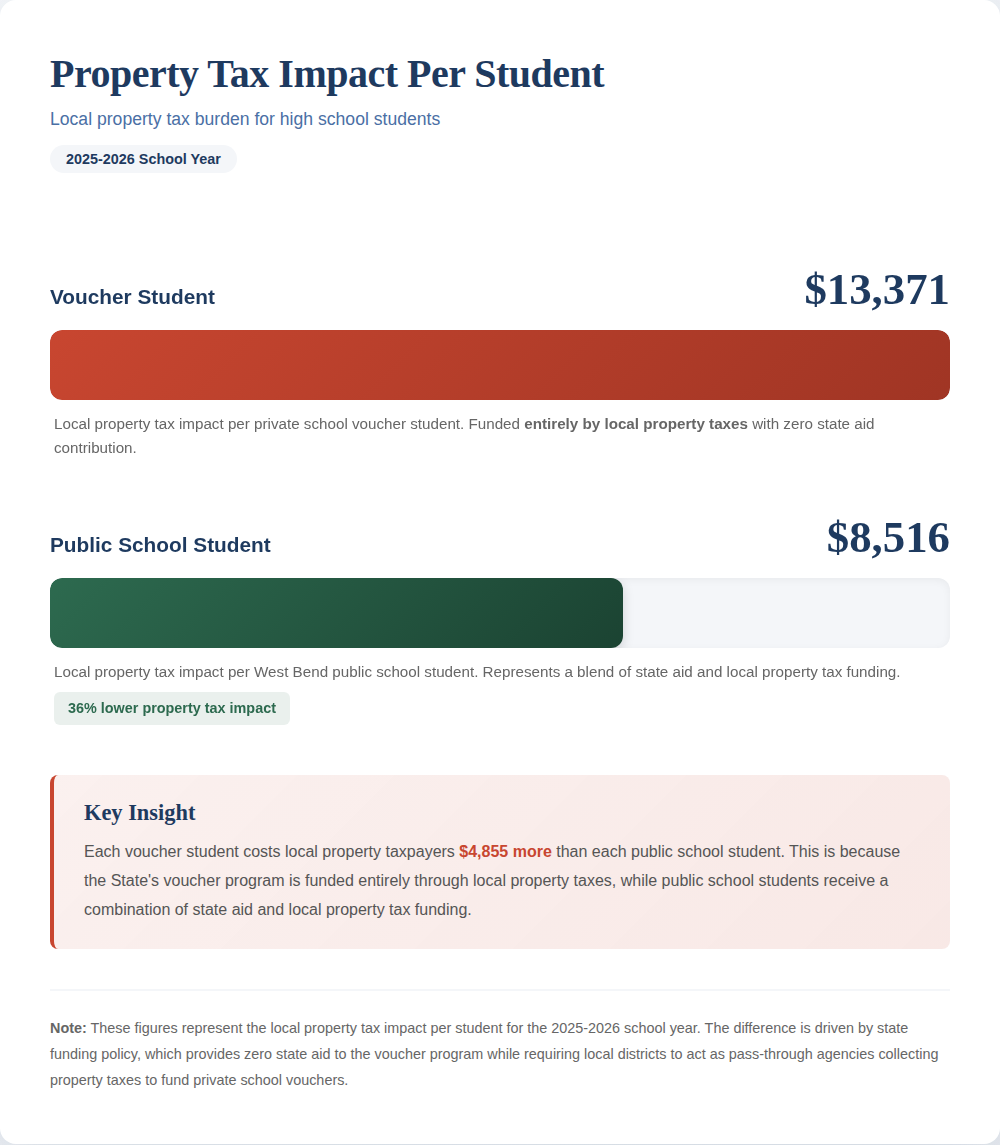

Is there a cost difference between a public school student and a voucher student?

Yes, there is a substantial difference in the local property tax impact due to the State's funding structure:

-

Because West Bend School District’s state aids are deduced to pay for resident students’ voucher costs, the district must use the property tax levy to replace the budget hole left by the aid deduction. As such, the current year costs of the Voucher Program is funded entirely by local property tax dollars.

-

For the current year (2025-2026), each voucher high school student is projected to cost the local property taxpayer approximately $13,371.

-

In contrast, each public school student results in a property tax impact of approximately $8,516

The high concentration of voucher schools in the West Bend, Jackson, and Newburg area, driven by our region's large and vibrant faith communities and the large WBSD attendance area, means our local taxpayers bear a higher burden for this state-mandated program compared to neighboring communities.

West Bend School District: A Record of Fiscal Discipline

The data confirms that the West Bend School District has maintained a responsible fiscal approach, successfully keeping the costs for public school operations far below the rate of inflation.

How much has the public school levy actually increased?

When we analyze the tax levy for the public school portion only (excluding the voucher pass-through funds) over the past four years (from 2021-2022 to 2025-2026):

-

The public school levy increased by a total of only 5.2% over the four-year period, averaging approximately 1.3% per year.

-

Inflation (CPI) over that same period rose by 18.4% (an average of 4.6% per year).

The District is clearly controlling costs. The taxes collected to fund your local public schools have increased at a rate more than three times lower than general inflation.

What about the Voucher Levy over the same period?

In stark contrast to the public school levy, the local levy collected for the State's voucher program has increased by 141.9% over the same four-year period. This dramatic increase is largely driven by the state's choice to increase the per-pupil amount for voucher students at a rate that has far outpaced the increases allowed for public school students.

Conclusion: Where to Direct Your Feedback

We appreciate your commitment to funding quality education. We want to emphasize that the significant tax changes you see related to school funding are directly attributable to state-level funding choices and policies, specifically:

-

The State freezing Equalization Aid, pushing all public school funding increases onto local taxpayers.

-

The dramatic, mandated increases in the local property tax levy for the State's Private School Voucher Program.

Your WBSD School Board and Administration are dedicated to maximizing efficiency and keeping our local mill rate for public education low. If you have concerns about the structure of school finance in Wisconsin and the burden placed on local property owners, we encourage you to contact your state legislators.

Other Tax Relief: Please also note that your total tax bill includes the School Levy Tax Credit, a form of property tax relief allocated by the state. While this credit is not directly deducted from the "school tax" line on your bill, it is allocated to you based on the school tax levy in your community. This tax credit is deducted from your total tax bill and serves to reduce your overall property tax burden.

Advanced Tax Bill Breakdown

The information provided above simplifies a very complex funding structure. For those community members who wish to see the specific line-item calculations and trace the numbers directly on their property tax statements, we have provided a detailed, technical guide at this link.

This guide will help you locate and understand:

-

The "Total School Levy" line item and why it contains two distinct funding streams.

-

The actual calculation used to derive the Public School Mill Rate ($5.38).

-

The School Levy Tax Credit and how it is applied as tax relief separate from the District's calculated levy.

For technical questions and comments regarding this website, including accessibility concerns, please contact the Webmaster.